Company Incorporation | 2 mins read | Last updated on 30 September 2019

The Accounting industry is evolving. With the advancement of technology, accounting works should be getting simpler and easier. Outsourced accounting has become a common solution for SME in Singapore. Not all businesses are suitable to outsource their accounting, but for most SME, outsourced accounting is always a better solution for expertise and cost saving.

# PRO 1: SAVE MONEY for Sales & Marketing Expenses

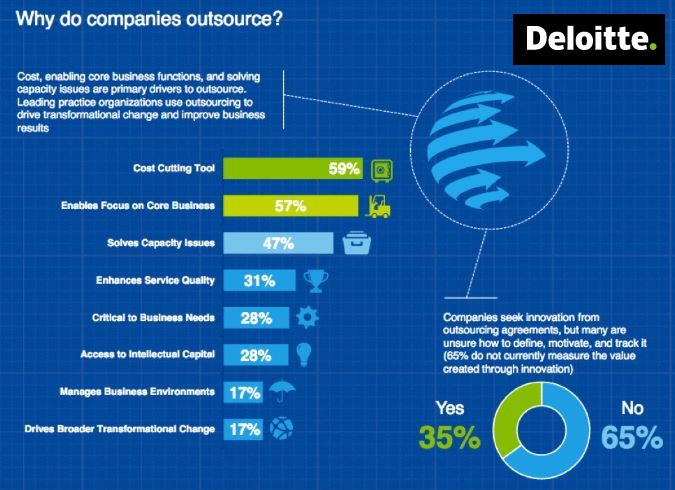

It is often cheaper and more cost effective than hiring a in-house staff. The value of having a team of expertise, rather than just a person, is definitely higher, especially for Start-Up Companies. Money saved can be reallocated into promoting our products and services more.

# PRO 2: SAVE TIME to focus on Core Business

Business owners or Directors will free up a chunk of their time and focus 100% on their products and services. We always have time to make money, but we can never have enough money to make time! Use our time wisely, and prioritize on important matters.